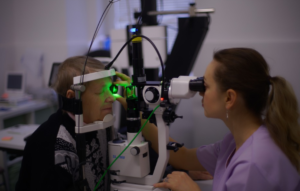

Isn’t it strange that you have car and home insurance, but don’t have any for your body? It’s great to ensure your possessions and belongings. This hesitation arises from health insurance, particularly if you’re used to having health informatics do it for you. Many blame the complicated enrollment process, seemingly limited options, and even monthly premiums as factors for not being insured. Freelancers are also often not covered, resulting in freelancers paying exorbitant premiums for medical expenses.

Importance of a Health Insurance

That’s the exact issue we’re engaging now, and we’re glad people are thinking about the main reason why they should invest their precious money in something. Getting sick is now rather miserable for someone who is self-explanatory. With the rising cost of health care, you might be faced with a rather stressful circumstance. You don’t have to sacrifice your peace of mind along with your hard-earned money during medical emergencies.

That’s the exact issue we’re engaging now, and we’re glad people are thinking about the main reason why they should invest their precious money in something. Getting sick is now rather miserable for someone who is self-explanatory. With the rising cost of health care, you might be faced with a rather stressful circumstance. You don’t have to sacrifice your peace of mind along with your hard-earned money during medical emergencies.

The Perfect Health Plan

It is nerve-wracking to think about which health insurance plan is excellent for me. There are many types of insurance plans that are made ideal for health, but not every program does not have to be the best for you. Therefore, before investing your money in insurance, do a lot of homework to get the most out of it. You are likely to enjoy the same specific policy on a portion of the cost, which will save you more money for other expenses. Choosing the right health insurance policy as a freelancer depends on your situation, along with your immediate and long-term wellness needs in the future.

Employer-Sponsored Health Insurance

If someone has been awarded employer-sponsored health insurance, you will discover titles like HMO and PPO. And in case you have opted for PPO, which stands for Preferred Provider Organization, then the insurance company will only cover a part of the cost of treatment. If you are at a young age and not dealing with chronic pain, then it is a great time to choose a health plan that includes high deductibles and co-payments.

If someone has been awarded employer-sponsored health insurance, you will discover titles like HMO and PPO. And in case you have opted for PPO, which stands for Preferred Provider Organization, then the insurance company will only cover a part of the cost of treatment. If you are at a young age and not dealing with chronic pain, then it is a great time to choose a health plan that includes high deductibles and co-payments.

Since you need less care and treatment, you won’t have to pay substantial monthly premiums. Meanwhile, even if you are ready for health insurance at an older age or have some chronic pain such as diabetes or illness, you must need intermittent visits and remedies.

Private Health Insurance

You do not need to join a company that provides a health insurance plan. You are likely to use it on your own without joining any agency or company. It can be the best short-term alternative if you missed the open membership period or suddenly faced with a medical crisis. Getting something on short notice is much better than going weeks without medical coverage. You won’t have to pay exorbitant premiums in case of emergencies, as long as you get self-employed health insurance yourself.…

Spread in money trading refers to the difference between the buying price and the selling price. Spreads in trading are much cheaper than those associated with the stock market and other types of trading. And this makes Forex, a far superior actual price procedure to earn more money. A large number of internet brokers present totally free accounts for new traders to practice trading and learn more about forex trading.

Spread in money trading refers to the difference between the buying price and the selling price. Spreads in trading are much cheaper than those associated with the stock market and other types of trading. And this makes Forex, a far superior actual price procedure to earn more money. A large number of internet brokers present totally free accounts for new traders to practice trading and learn more about forex trading.

Investing in gold offers easy liquidity, unlike other types of investments. You are likely to be able to buy or sell gold jewelry or gold transactions whenever you want. As a result, costs will not go down. They are likely to continue to rise. When there is a recession, many people tend to invest in gold, which contributes to the cost of gold going up. You can make a good profit if you sell the gold you have invested in, as the cost of gold will continue to rise.

Investing in gold offers easy liquidity, unlike other types of investments. You are likely to be able to buy or sell gold jewelry or gold transactions whenever you want. As a result, costs will not go down. They are likely to continue to rise. When there is a recession, many people tend to invest in gold, which contributes to the cost of gold going up. You can make a good profit if you sell the gold you have invested in, as the cost of gold will continue to rise.

Since banks can easily be the biggest lenders out there, they are likely to be able to offer you some of their best interest rates along with the amounts of money you might be looking for. However, the current recession has caused banks to seriously tighten their purse strings depending on who is giving the money – unless you are fairly confident in your credit, which you can check by requesting a copy of your credit report from a provider.

Since banks can easily be the biggest lenders out there, they are likely to be able to offer you some of their best interest rates along with the amounts of money you might be looking for. However, the current recession has caused banks to seriously tighten their purse strings depending on who is giving the money – unless you are fairly confident in your credit, which you can check by requesting a copy of your credit report from a provider. These options seem like hard work, especially if you want to visit places in person to get the best deal. Fortunately, there is another option that can do these things at exactly the same time: talk to a loan broker. Many loan brokerage companies have a large number of lenders on their books, and they can often find a wide selection of loan options by comparing your personal information with the criteria each lender has on their products.

These options seem like hard work, especially if you want to visit places in person to get the best deal. Fortunately, there is another option that can do these things at exactly the same time: talk to a loan broker. Many loan brokerage companies have a large number of lenders on their books, and they can often find a wide selection of loan options by comparing your personal information with the criteria each lender has on their products. Like lending companies, brokers vary widely, so it makes sense to look for a good broker. Ideally, you should find a broker that not only has the best number of lenders on its books but also doesn’t charge you a fee for its services until you’ve obtained the loan you need; some people want money until they find a loan that’s right for you, so only be aware of your obligations to them until you ask them for advice. You can do this by doing some research about loans and the obligations you will have.…

Like lending companies, brokers vary widely, so it makes sense to look for a good broker. Ideally, you should find a broker that not only has the best number of lenders on its books but also doesn’t charge you a fee for its services until you’ve obtained the loan you need; some people want money until they find a loan that’s right for you, so only be aware of your obligations to them until you ask them for advice. You can do this by doing some research about loans and the obligations you will have.…

Concerning the gold varying worth, it might be the most suitable choice in investing the riches for your future. Afterward, this investment method is quite secure due to its performance. The values of this gold are consistent as opposed to other investments. In any case, people may feel safer in this fickle world than investing in various types, like stocks. It relates to the outbreak scenario; golden values tend to get trapped.

Concerning the gold varying worth, it might be the most suitable choice in investing the riches for your future. Afterward, this investment method is quite secure due to its performance. The values of this gold are consistent as opposed to other investments. In any case, people may feel safer in this fickle world than investing in various types, like stocks. It relates to the outbreak scenario; golden values tend to get trapped.

You’re trying to pay down debt, so make sure you’re not adding new debt to the mix at exactly the same time you’re doing it. You should make sure you don’t spend your credit cards in the process. If you know you’re tempted to use them, it’s a great idea to cut them up or lock them up. If you can avoid spending them, put them somewhere and make sure you probably won’t use them. You certainly don’t want to add debt to your problems. So listen to the debt you are in and focus on getting out of it.

You’re trying to pay down debt, so make sure you’re not adding new debt to the mix at exactly the same time you’re doing it. You should make sure you don’t spend your credit cards in the process. If you know you’re tempted to use them, it’s a great idea to cut them up or lock them up. If you can avoid spending them, put them somewhere and make sure you probably won’t use them. You certainly don’t want to add debt to your problems. So listen to the debt you are in and focus on getting out of it.

Regardless of Algo trading being in the incipient phase, it includes almost 50 percent of the general trading in some states. The sum is meager compared with the US and the UK markets in which more than 90% of the transactions are performed using automated steps.

Regardless of Algo trading being in the incipient phase, it includes almost 50 percent of the general trading in some states. The sum is meager compared with the US and the UK markets in which more than 90% of the transactions are performed using automated steps.

Examples of third-party payers are individual insurance policies, personal insurance, and self-insurance policies that focus on their income and industrial insurance. This type of insurance is a wonderful source of income for healthcare professionals in the medical market. Health insurance

Examples of third-party payers are individual insurance policies, personal insurance, and self-insurance policies that focus on their income and industrial insurance. This type of insurance is a wonderful source of income for healthcare professionals in the medical market. Health insurance

Nowadays, you can get loans from lenders and banks. But when you apply for financing, some important things to consider could allow you to compare short-term loans. The value guarantees short-term in

Nowadays, you can get loans from lenders and banks. But when you apply for financing, some important things to consider could allow you to compare short-term loans. The value guarantees short-term in  In such cases, be sure to promise the lender your property or household documents. So, if you want a short-term loan, you should consider the important factors described in this report. They will allow you to buy and avoid the kind of perfect mistake that is most common at all times. I hope that with this information, you can get the ideal type of short-term loan. Some many lenders and brokers offer short-term loans for many different functions. Find out more about lenders and brokers and use free websites to compare loans.

In such cases, be sure to promise the lender your property or household documents. So, if you want a short-term loan, you should consider the important factors described in this report. They will allow you to buy and avoid the kind of perfect mistake that is most common at all times. I hope that with this information, you can get the ideal type of short-term loan. Some many lenders and brokers offer short-term loans for many different functions. Find out more about lenders and brokers and use free websites to compare loans. For short-term loans, it may be necessary to create a deposit. This amount is usually 5 to 10 percent of the amount of this loan. Some lenders may also offer a 100% financing option. In these cases, you may want to pay additional interest. For this reason, you need to know and check the number of services and make a selection. Repayment is a significant amount of money to EMIs and determines their ability to repay.

For short-term loans, it may be necessary to create a deposit. This amount is usually 5 to 10 percent of the amount of this loan. Some lenders may also offer a 100% financing option. In these cases, you may want to pay additional interest. For this reason, you need to know and check the number of services and make a selection. Repayment is a significant amount of money to EMIs and determines their ability to repay.

The APR lets you know that this loan’s actual price is complete since it consists of all of the expenses the lender is charging you (agent charges, origination expenses, etc.) and interest. Interest rates include the expense of borrowing the money. So once you’re talking about financing with the lender, this speed is the most important since it’s how

The APR lets you know that this loan’s actual price is complete since it consists of all of the expenses the lender is charging you (agent charges, origination expenses, etc.) and interest. Interest rates include the expense of borrowing the money. So once you’re talking about financing with the lender, this speed is the most important since it’s how

Gold bullion bars are available in nineteen various sizes. Their weight varies from a small 1 gram bar up to 400 ounces which are known as the London Good Bar. Thus, the differences in weight mean a variation in the gold bars prices that ranges from twenty to one hundred forty thousand US dollars. This vast range in price gives many opportunities for all investors.

Gold bullion bars are available in nineteen various sizes. Their weight varies from a small 1 gram bar up to 400 ounces which are known as the London Good Bar. Thus, the differences in weight mean a variation in the gold bars prices that ranges from twenty to one hundred forty thousand US dollars. This vast range in price gives many opportunities for all investors. You also have the chance to invest in gold bullion coins aside from investing in gold bullion bars. Investing in coins makes it simple for investors to monitor the daily value of their gold coin investments. Most bullion coins are made of pure gold, and the cost of one ounce of gold is usually reported daily in newspapers.

You also have the chance to invest in gold bullion coins aside from investing in gold bullion bars. Investing in coins makes it simple for investors to monitor the daily value of their gold coin investments. Most bullion coins are made of pure gold, and the cost of one ounce of gold is usually reported daily in newspapers.

In general, there are two variants of taxi insurance, dividing into private and public coverage. The public insurance provides compensation for damages and accidents of the public taxi hire service, especially drivers who do not own the vehicle. Meanwhile, self-employed taxi drivers who are mostly associated with a group of travel or private hire basis get coverage facilities through private insurance. Selecting one of them is easy referring to your status, but throwing away your doubt to get you taxi insurance might be hard. Keep read and find a brief explanation of why you should have a

In general, there are two variants of taxi insurance, dividing into private and public coverage. The public insurance provides compensation for damages and accidents of the public taxi hire service, especially drivers who do not own the vehicle. Meanwhile, self-employed taxi drivers who are mostly associated with a group of travel or private hire basis get coverage facilities through private insurance. Selecting one of them is easy referring to your status, but throwing away your doubt to get you taxi insurance might be hard. Keep read and find a brief explanation of why you should have a  Taxi hire insurance is often more expensive than conventional car insurance. However, the cost depends on the type of insurance service you want to register. The private taxi hire insurance offers three main coverage: any driver, named driver, or only policy. The latest is the cheapest insurance type, and the more names are on the plan, the more expensive the insurance would be. On the other hand, the first plan is the most costly because any drivers can operate the cab. The best one might be the named driver plan because you purchase coverage for yourself. Also, remember to find taxi insurance at a reasonable price and in line with the service and quotes. This way, you can have the right coverage with a cost-effective plan when something happens for your future reference.

Taxi hire insurance is often more expensive than conventional car insurance. However, the cost depends on the type of insurance service you want to register. The private taxi hire insurance offers three main coverage: any driver, named driver, or only policy. The latest is the cheapest insurance type, and the more names are on the plan, the more expensive the insurance would be. On the other hand, the first plan is the most costly because any drivers can operate the cab. The best one might be the named driver plan because you purchase coverage for yourself. Also, remember to find taxi insurance at a reasonable price and in line with the service and quotes. This way, you can have the right coverage with a cost-effective plan when something happens for your future reference.

One of the most prominent proposals for making money online right now is writing. You don’t have to become a professional writer. Some people today think they need a degree in English or journalism and writing projects. Writing online is not the same as writing for textbooks or printing books.

One of the most prominent proposals for making money online right now is writing. You don’t have to become a professional writer. Some people today think they need a degree in English or journalism and writing projects. Writing online is not the same as writing for textbooks or printing books.

The prerequisite for applying for a loan is a fantastic credit rating, so you can be sure you will find the credit. Be sure to deduct any charges, particularly credit card charges, which will be taken into account when you start processing the program.

The prerequisite for applying for a loan is a fantastic credit rating, so you can be sure you will find the credit. Be sure to deduct any charges, particularly credit card charges, which will be taken into account when you start processing the program.

High Profits

High Profits

Oatmeal is an excellent snack for the kids since it is delicious and has several health benefits. The oatmeal snack can be given to a kid in the morning, especially during breakfast. The oatmeal is rich in fiber, which improves the kid’s digestion. You can opt to make oatmeal using milk instead of water for more health benefits. Therefore considering oatmeal as a snack for your kids is a great idea.

Oatmeal is an excellent snack for the kids since it is delicious and has several health benefits. The oatmeal snack can be given to a kid in the morning, especially during breakfast. The oatmeal is rich in fiber, which improves the kid’s digestion. You can opt to make oatmeal using milk instead of water for more health benefits. Therefore considering oatmeal as a snack for your kids is a great idea.

Stats show that over 2.4 billion people use social media on a regular basis. Therefore, a startup that incorporates social media channel as a way of marketing their products can improve their chances of growth. Growing social media presence helps people to recognize a business. Besides, social media channels such as Facebook allows marketers to create ads that appear in the news feed of users. Marketers can also adjust their ads to suit users in specific locations. However, startup owners must create engaging posts that give users valid reasons to follow their accounts. It can be easy for them to engage their users once they have attracted them to stay connected.

Stats show that over 2.4 billion people use social media on a regular basis. Therefore, a startup that incorporates social media channel as a way of marketing their products can improve their chances of growth. Growing social media presence helps people to recognize a business. Besides, social media channels such as Facebook allows marketers to create ads that appear in the news feed of users. Marketers can also adjust their ads to suit users in specific locations. However, startup owners must create engaging posts that give users valid reasons to follow their accounts. It can be easy for them to engage their users once they have attracted them to stay connected.